Ethereum Leverage Trading

Overbit allows you to magnify your Ethereum exposure to the market with up to 50X leverage. Profit from rising and falling markets.

Margin Trading using Ethereum

Vitalik Buterin created Ethereum in 2015 as a platform to go beyond the digital payment function of Bitcoin. Hence, Ethereum allows for decentralised applications powered through smart contracts. Programmers build on the network and host dapps that serve varied purposes like lending and borrowing (what we see in DeFi today), tokenisation of arts and digital products (NFTs), securing public records and much more. Ethereum powers the DeFi sector where investors (individuals and corporates) stake over 80 billion USD in various smart contracts.

Ethereum has its native currency called Ether. Ether is used for paying transaction fees on the network. Whether as a dapp developer coding smart contracts, each transaction you make on the network demands that you pay a fee in Ether for the transaction to be confirmed by validators on the network. Technically, this is also referred to as a gas fee, which varies depending on how congested the network is or how complex the smart contract transaction is.

Benefits of Trading Ethereum

After Bitcoin, Ethereum is the second-largest cryptocurrency by market capitalisation with several other ERC20 tokens built on top of it. Its average daily trading volume is $35 billion USD – making it very liquid for trading. As Ethereum is the choice platform for most DeFi applications, it continues to grow in popularity as more platforms build on it.

Just like Bitcoin, the Ethereum trading market is open 24 hours a day, 7 days a week, including public holidays. Ethereum block explorers can provide a lot of insight to traders on the current movements of tokens and Ethereum itself. You can also estimate and predict movements in the Ethereum price that can be triggered by lack of network capacity due to complex applications being in demand.

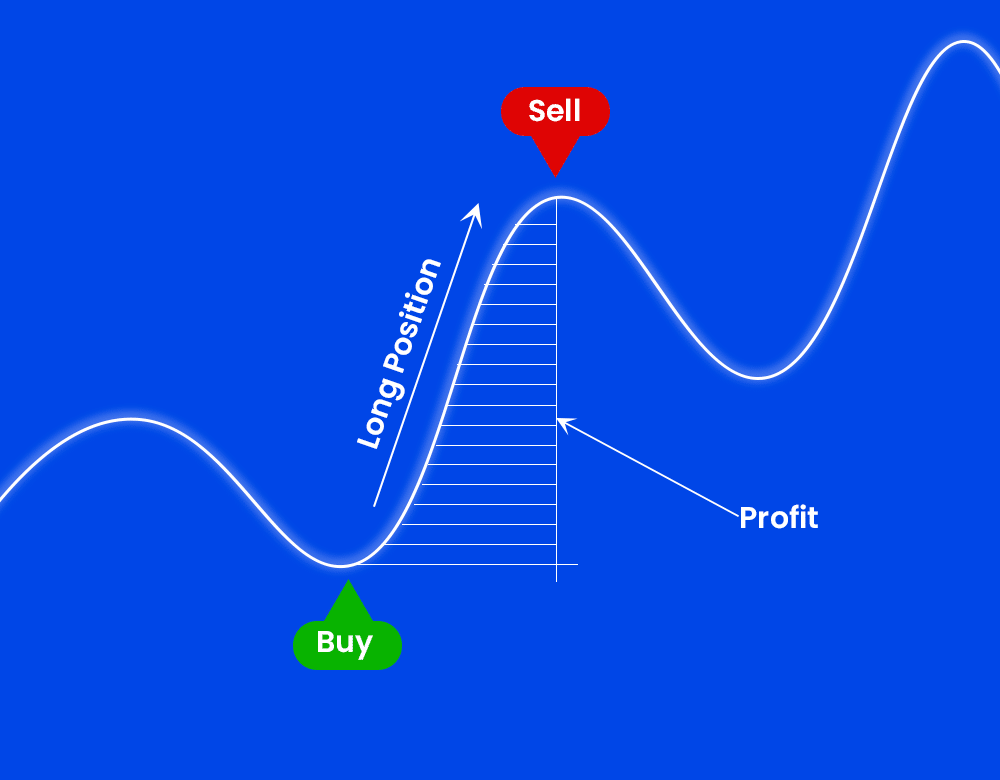

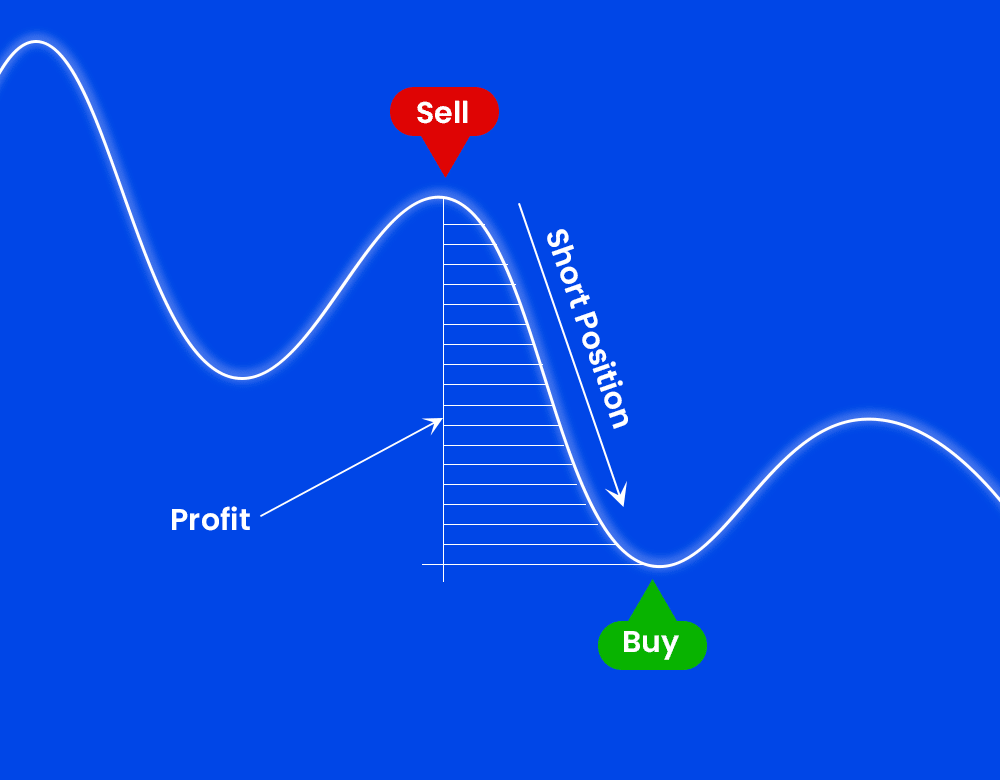

Make profits when Ethereum goes up or down

Go long or go short on Ethereum when the price is rising or falling using the Overbit platform. Profit from trading both ways without taking delivery of ETH.

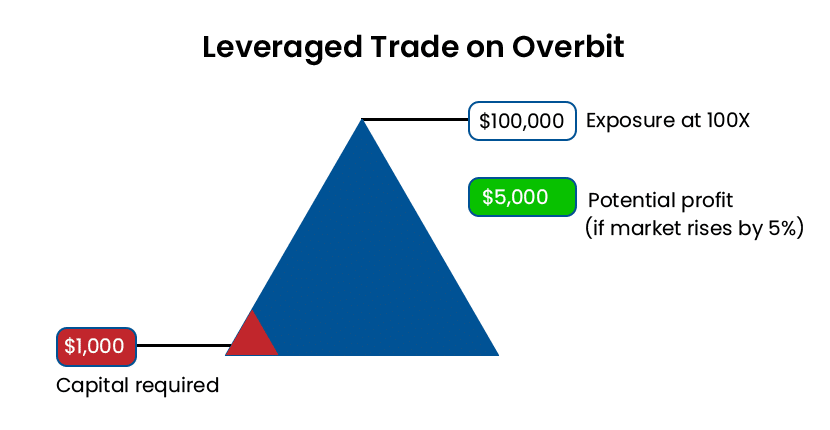

Trading Ethereum with leverage

Overbit allows you to trade Ethereum with leverage. This means you can trade Ethereum using your Bitcoin or USDT without taking delivery of the ETH. With leverage you get a lore more exposure to the Ethereum price movement than the amount you deposit. As an example, say the ETH price is 2,000 USD and Vitalik Buterin is about to make a speech where he is announcing some important features to be added to the Ethereum blockchain. You believe this will make the price go up to 2,500 USD. You deposit 1,000 USD and you wish to buy 25 ETH with 50X leverage. At 50X leverage, your margin requirement is 1/50 * 2,000 * 25 = 1,000 USD.

If the market increases to 2,500 USD – then your profit is 500 * 25 = $12,500. However, if the Ethereum price goes down by 40 USD down to 1,960 USD then you would lose your entire 1,000 USD.

A similar example can be applied if you are expecting Etherem to go down in value. Let’s say ETH is currently trading at 2,000 USD and you expect the price to fall by 500 USD. You buy the same quantity of ETH with 50X leverage, therefore your margin is 1/50 * 2,000 * 25 = 1,000 USD. If the price falls by 500 USD down to 1,500 USD, then you stand to make 25 * 500 = 12,500 USD profit. However, if the market moves up by a mere 40 USD, then you stand to lose the entire 1,000 USD.

You can get a more accurate calculation of the margin requirement and your liquidation price in Bitcoin or USDT – on the deal ticket window of the Overbit trader.

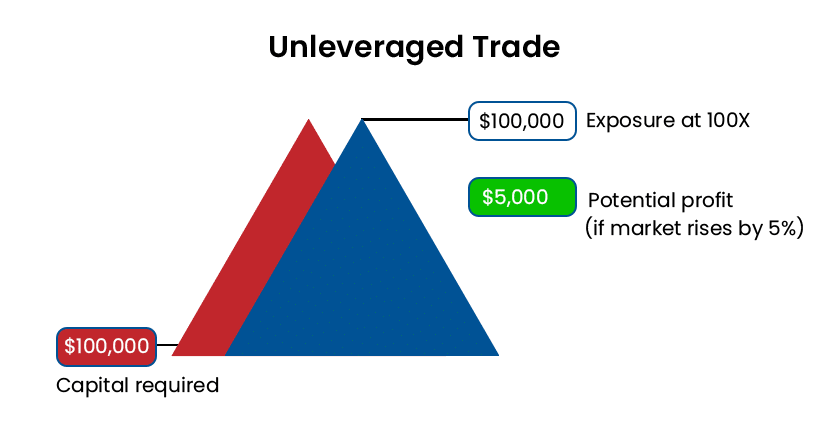

How Ethereum leverage works

With an Ethereum leveraged trade, you can get up to 50X the exposure of the capital you deposit.

Why trade Ethereum with Overbit

Overbit is a world-class exchange with a deep and liquid order book from our multiple global liquidity partners. Our traders enjoy fair market prices consolidated from the world’s top exchanges and are free from price manipulation. This means no single trader can manipulate prices on Overbit with large positions. At Overbit, you can trade Ethereum using your Bitcoin or USDT without the need of taking delivery of assets. We provide a wide range of features in leverage trading. On Overbit, you can trade Ethereum with up to 50X leverage. However, in order to limit your risk exposure, we employ advanced risk management measures. We allow you to open each position with your own margin preference (isolated margin or cross margin). Overbit recognizes and rewards community efforts by running one of the best affiliate programs from any crypto exchange. Users get rewarded in BTC or USDT for referring friends. This is unarguably the most rewarding cryptocurrency affiliate program in the world. As a way to incentivize the continued use of our exchange, we operate a tiered reward program. Traders get rewarded in Tier Points (TP) for trading. Once you reach 1,000 TP, you can swap for BTC or USDT. You never have to worry about the security of your funds on our exchange as we employ military-grade security to ensure customers’ funds are always safe. We segregate user funds to ensure they are protected, and stored in multi-signature cold wallets. If you ever need our support team, we offer 24/7 live chat support to all users.

Fair Market Pricing

Overbit uses market prices consolidated from the world's top exchanges and are free from price manipulation.

Isolated & Cross Margins

Advanced risk management to limit your exposure. Overbit allows you to open each position with your own margin preference.

Military Grade Security

Client funds are always segregated, protected, and stored in multi-signature cold wallets.

Deep Liquidity

Overbit operates a deep order book using multiple liquidity providers globally.

Generous Rewards

Earn Tier Points from trading and take a chance in the Overbit rewards hub.

24/7 Customer Support

Overbit offers 24/7 live chat support to all users. We are there when you need us.

Markets you can long or short

Earn up to $120 USD

when you join Overbit

Discover the Overbit Rewards Hub, Earn Bitcoin when you join Overbit and even more when you refer friends.

Overbit is a Bitcoin margin trading platform, headquartered in Seychelles. Overbit offers a range of markets within Crypto, Forex and Commodities – with leverage of up to 125X for crypto and 800X for Forex.

Features

Overbit does not accept applications from residents of the United States of America, United Kingdom, Canada, Cuba, Iran, North Korea, Singapore, Seychelles, Crimea and Sevastopol, Sudan and Syria. The information on this website is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Risk Warning: Margin Trading carries a high level of risk to your capital and you should only trade with money you can afford to lose. Margin Trading may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. Read our Risk Disclosure Statement to find out more.